• The initial investment in BEVs is almost 3 times more than what is required to acquire an ICE vehicle.

• Battery technologies are advancing exponentially with time as costs reduce by almost 15% every year.

The global market is observing an inflationary trend which is a direct consequence of spike in energy costs and disruptions in the supply chain. This in turn has led to industries depending upon semiconductors, fossil fuels and electricity to increase base prices at an unprecedented pace. At the same time because of these shortages, the electric vehicle industry is all set to experience a sharp increase in sales. However, the problem arises with decisions concerned with which type of electric vehicle to be made to meet the surge in demand.

Currently, the EV market has three main technologies that are being commercialized – battery electric vehicles which are pure electric vehicles without secondary sources of propulsion, plug-in hybrid/hybrid electric vehicles which are electric vehicles that combine battery driven propulsion and secondary propulsion such as internal combustion, and fuel cell hydrogen electric vehicles which utilize fuel cell technology with hydrogen as fuel needed to provide power to the vehicle.

It is significant to note that hydrogen fuel cell technology is in its nascent stages while the countries such as Japan and South Korea are investing heavily on the R&D of these vehicles. Hydrogen fuel electric vehicles and multiple models in different categories of vehicles are set to be launched in the upcoming years but the technology itself cannot draw parallels when it comes to advancements made in the battery electric vehicles and plug-in hybrid electric vehicles.

Figure 1: Global annual market of trucks in 2020 and 2030.

Source: Power Technology Research

Figure 2: Global annual market of buses in 2020 and 2030.

Source: Power Technology Research

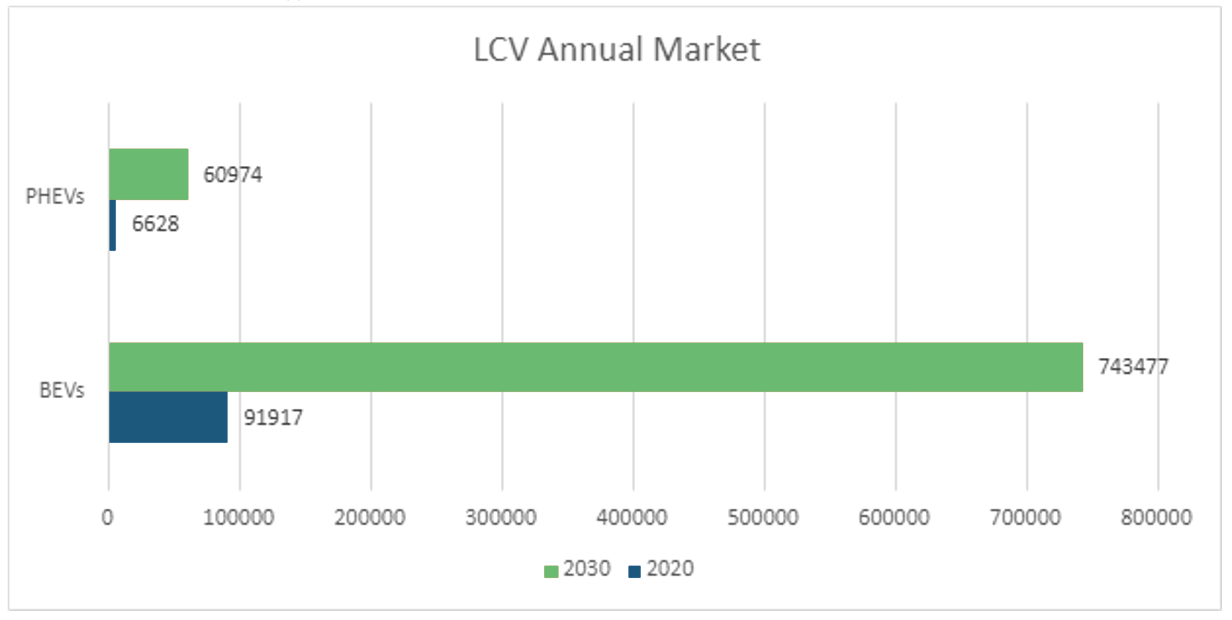

Figure 3: Global annual market of LCVs in 2020 and 2030.

Source: Power Technology Research

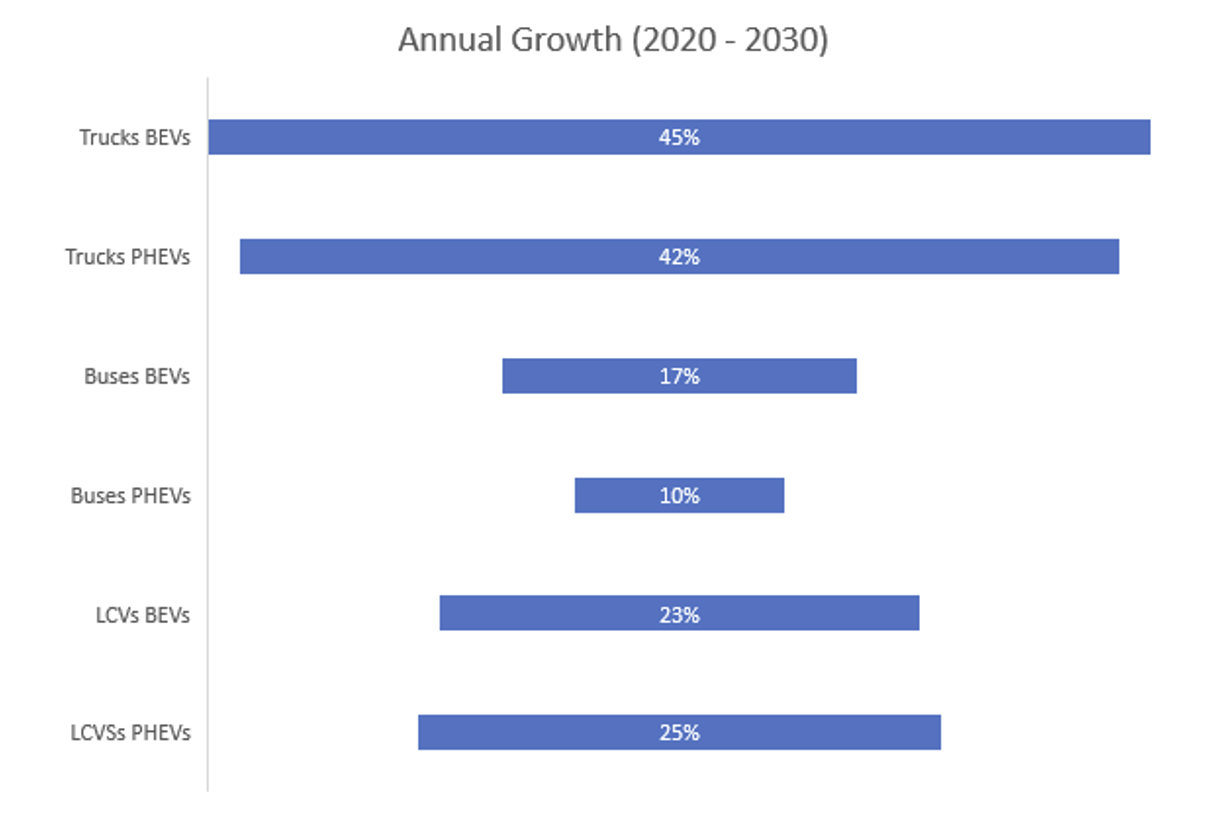

Figure 4: Annual growth of trucks, buses and LCVs (BEVs and PHEVs).

Source: Power Technology Research

Comparison of Technologies

When it comes to BEVs, they have a far more significant role in tackling climate change than PHEVs as they are zero emission vehicles. However, the uptake of BEVs is inhibited by range anxiety. For instance, it was observed that range anxiety has pushed several fleet operators away from the technology. It happened mainly due to the possibility of interruptions during commutation and travelling. Additionally, the initial investment in BEVs is 3 times more than what is required for an ICE.

In order to mitigate issues like range anxiety, governments globally along with countries’ private sectors are investing heavily in vehicle charging infrastructure. For instance, Europe is currently developing the TEN-T network while Germany is investing in a fully charging capable highway network. Although, it is expected that the issue of range anxiety would be largely resolved, it is not expected to be resolved enough that BEVs would replace Class 8 Trucks.

If we look at PHEVs and HEVs, no range anxiety exists as these vehicles rely on both battery and secondary sources of power such as the conventional ICE that not only provides charge to the battery but drives the vehicle as well. However, the problems with PHEVs and HEVs is that they are not zero emission vehicles and are relatively less helpful in meeting net carbon neutrality goals. ROI projections also do not help the cause of PHEVs and HEVs, especially given the recent surge in the fuel prices across the globe. A large number of countries are experiencing over a 50% increase in fuel prices. This essentially pushes the breakeven point on ROI for PHEVs and HEVs further away while bringing the same for BEVs earlier.

Electric vehicles have been advertised and marketed on two fronts: a change needed to save environment and a cost-effective way to travel. Regardless of the initial cost of the electric vehicle, these vehicles have substantially cut down the transportation costs as they remove the aspect of fuel from the process. With BEVs and HEVs, however, this aspect remains an integral part of the equation which in turn is driving developing nations and medium-tier economies away from the technology because of long term costs which in most cases is a burden.

Looking Ahead

According to Power Technology Research, different trends will be observed across vehicle segments. For instance, BEVs are popular mostly in medium sized trucks and buses mainly because of small range constraints and faster ROI. Additionally, buses and trucks are widely present in the global transportation network and contribute significantly towards greenhouse gas emissions. However, on the other hand, PHEVs have gained momentum in the LCV segment as they are smaller and more affordable vehicles. This in turn has provided incentive to the small-medium industries to adopt them, keeping in view both the financial constraints and the environmental initiatives.

Furthermore, battery technologies are advancing exponentially with time with costs reducing by almost 15% every year which in turn suggests that in the long run BEVs will become efficient enough to completely replace ICE vehicles while being the most preferred type of electric travel.

EV Charging Infrastructure Service Overview

The research presented in this article is from PTR's EV Charging Infrastructure market research. For information about this service please submit a request shown below.

Contact Sales:

More about our:

EV Charging Infrastructure Market Research

Recent Insights

European Electric Vehicle Charging Infrastructure (EVCI) Services Market Landscape

This infographic gives an overview of the electric vehicle charging infrastructure (EVCI) services market in the European region. It highlights the...

Exploring the European EVCI Services Market Key Players and Emerging Trends

There has been a significant surge in the development of EVCI due to the widespread adoption of EVs in Europe. By 2030, it is expected that Europe...

Global EV Market: Analysis of EV Sales Slowdown in 2023

• EV sales were impacted adversely in 2023 on account of various factors, including price disparity, consumer perception and supply chain...