• Distribution transformer market of China is expected to grow with a CAGR of 6.4% (in terms of units) from 2022-2027.

• Majority of the distribution transformers demanded in China are in the voltage range of 1-12 kV accounting for 91% of the annual market.

• China has set quite aggressive solar and wind energy targets for themselves which are in turn expected to generate demand for legacy equipment including the distribution transformers in the country.

A distribution transformer is a transformer that steps down the voltage in the distribution lines to the level that is acceptable to the customer. Globally these transformers have a huge installed base with China as one of the leading markets of distribution transformers in the world. The global distribution transformer market observed a decline in growth during Covid-19 (a dip of 7.6% yoy in terms of revenue) but the Chinese distribution transformer several impediments showed resilience (grew 5.7% yoy in terms of revenue).

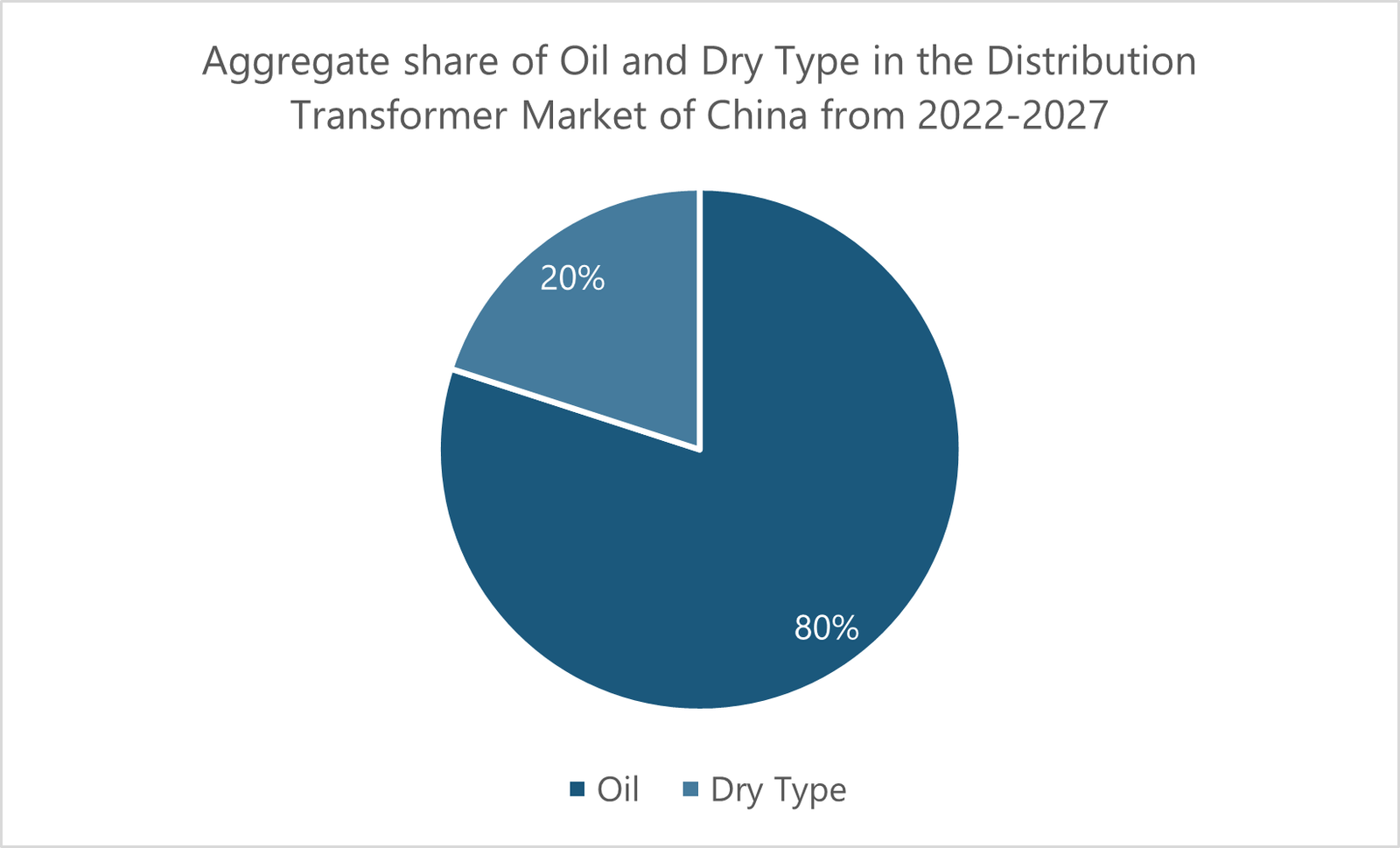

The distribution transformer market of China accounted for 22% of the global distribution transformer market in terms of revenue and the market is expected to grow with a CAGR of 6.4% (in terms of units) from 2022-2027. In 2021, nearly 80% of the annual distribution transformers sold in China were pole-mounted transformers while the rest 20% were pad-mounted. On the other hand, in 2021, around 79% of the distribution transformers sold in China were oil-type distribution transformers while around 21% of the distribution transformers sold were dry type. Sale volumes of dry and oil type in the Chinese distribution transformer market are not expected to observe a significant change over the next five years.

As far as the dominant voltage levels in the annual market of distribution transformers in the country are concerned, the majority of the distribution transformers were in the voltage range of 1-12 kV accounting for 91% of the annual market in 2020. In China’s annual distribution transformer market, nearly 3% of the distribution transformers demanded were in the voltage range of 17.5-24 kV while only 6% of the distribution transformer market are in the voltage range of 24-42 kV. No distribution transformers in the voltage range of 12-17.5 kV were demanded in the annual distribution transformer market of the country at least in 2020.

Demand Drivers of the Distribution Transformer Market of China

The distribution transformer market of China is largely driven by uptake in the renewables followed by widespread deployment of charging infrastructure that is pushing utilities and governments to expand and modernize their network.

Renewables

China has set quite aggressive solar and wind energy targets for themselves which are in turn expected to generate demand for legacy equipment including the distribution transformers in the country. The country is expected to increase the solar generation installed capacity from 255 GW to 509 GW with a CAGR of 15% during 2021-2027 while wind generation installed capacity is expected to increase from 373 GW to 598 GW with a CAGR of 10% during the same period.

Electrification of the Transport Sector

To deal with the impact of climate change and reduce the country’s oil import bill China is pushing for the electrification of the transportation sector. The country has set a target for EV sales to increase four times by 2025 accounting for 20% of the total car sales per annum. Currently, China’s electric vehicle market is the biggest in the world with a market share of more than 50% for 4 consecutive years (at the global level). In order to sustain the uptake of electric vehicles in the country, China is aggressively deploying charging infrastructure. It has also unveiled the ‘New Energy Automobile Industry Development Plan (2021-2035)’ which focuses on not only the widespread deployment of charging infrastructure in the country but also on improving the service quality at charging stations. It is significant to note that widespread deployment of charging infrastructure in the country requires the upgradation of the transmission and distribution network. As the country responds to the need for upgradation of T&D infrastructure, it will create the demand for distribution transformers in China which is expected to drive the market in coming years.

Figure 1: Aggregate share of Oil and Dry Type in the Distribution Transformer Market of China from 2022-2027

Source: Power Technology Research

Figure 2: Solar and Wind Energy Targets of China.

Source: International Energy Agency

Looking Ahead

The distribution transformer market of China in the coming years will be driven by renewable generation (solar and wind energy) expansion plans and the widespread deployment of charging infrastructure to support the uptake of electric vehicles in the country. According to the International Energy Agency installed base of solar generation is expected to grow with a CAGR of 15% and wind with a CAGR of 10% from 2022-2027. China has invested around USD 500 billion from 2016-2022 in the electricity grid infrastructure as per the estimates of IEA and is expected to make substantial investments in the future as well to cater to the integration of renewables and deployment of EV charging infrastructure.

Distribution Transformers Service Overview

The research presented in this article is from PTR's Distribution Transformer service. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

Power Transformer Market Research

Recent Insights

Evolution of DOE 2027-2056 Efficiency Standards: Impacts on the Distribution Transformer Industry

• One aspect of the DOE 2027-2056 proposed law advocates for amorphous steel in the manufacturing of distribution transformers.• Deployment of the...

US and EU Strategies in Smart Buildings

Download Service Overview The EU and USA aim to decarbonize their building sectors to meet emission reduction targets. Initiatives like the Home...

Navigating the Evolving Terrain: An Exploration of the Distribution Transformers Market in the MEA Region

The distribution transformer market for the Middle East and Africa (MEA) region is the smallest compared to other regions. Three countries,...