- To enable a smoother transition to clean energy and electrification of the transport sector, a robust battery supply chain is of the utmost importance.

- According to Benchmark Mineral Intelligence, China is constructing one giga factory per week while the U.S. is building one every four months.

- China would will remain the leader in the battery storage market mainly due to consistent investment in this sector.

Advanced economies across the globe have set ambitious targets to reduce greenhouse gas emissions aimed at keeping global warming and the consequences associated with climate change at bay. In order to enable a smoother transition to clean energy and the electrification of the transport sector, a robust battery supply chain is of the utmost importance.

Reduction in the battery costs, specifically lithium-ion batteries, followed by the uptake of EVs and the need for flexibility in the grid which can be met through energy storage, has all led to an increase in the deployment of giga factories. That said, in addition to the already existing industrial base, sophisticated innovation and technology available in North America, Europe, and Asia has been spearheading the global battery supply chain development over the past decade and is expected to keep doing so in the future as well.

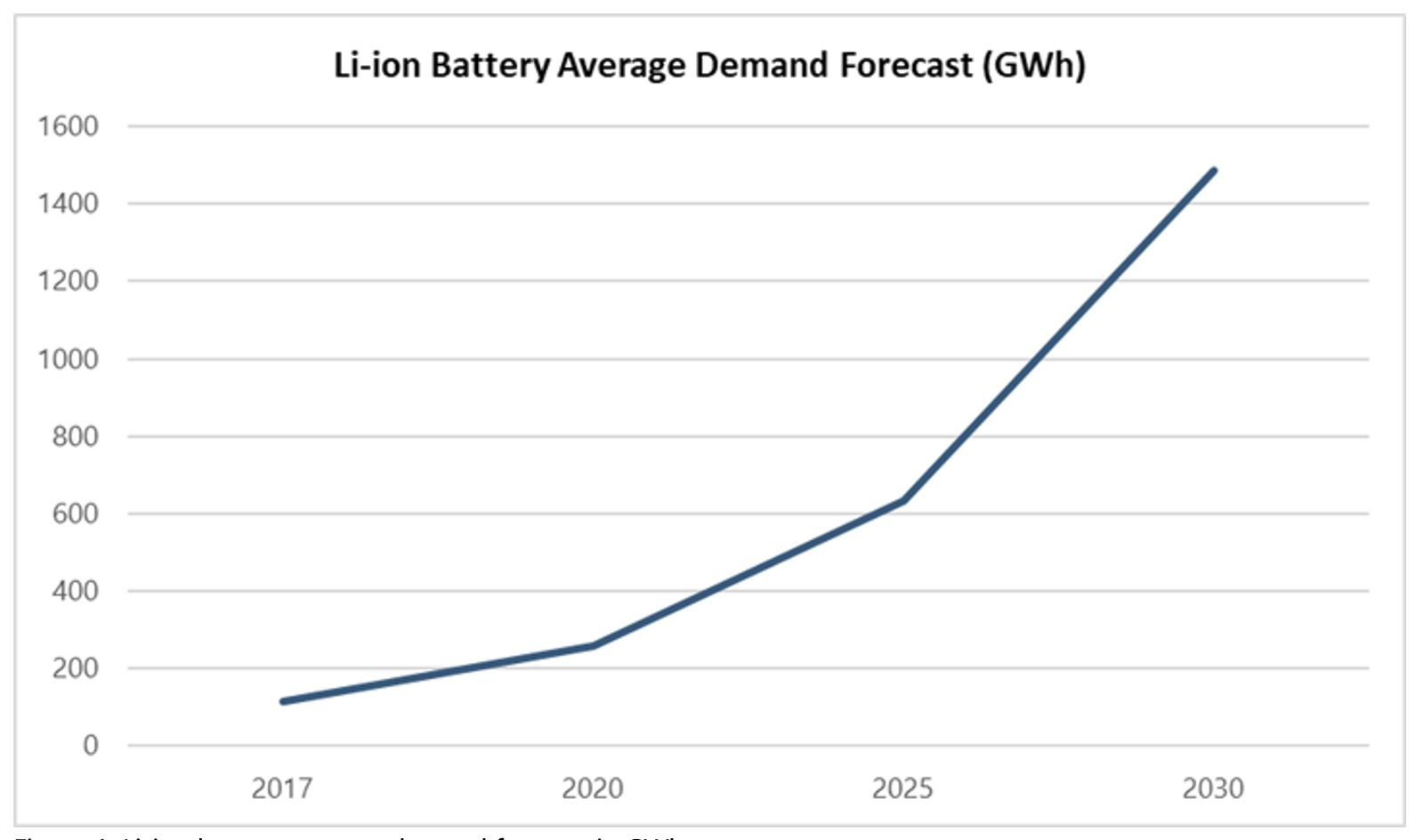

Figure 1: Li-ion battery average demand forecast in GWh.

Source: Alkem

China- A Leader in Battery Supply Chain

Huge domestic battery demand (in terms of energy storage as well as the number of batteries) followed by control of 80% of the world’s raw material refining as well as massive investments being made with suitable policy framework has made China a leader in the battery supply chain. Australia has emerged as the principal exporter of lithium minerals where China is the leading importer of lithium; 80% of Australia’s lithium production goes to China in the form of unprocessed mineral ores.

As far as batteries are concerned, China has established its presence at all levels of the supply chain. At the top of supply chain lies the collection of raw materials such as lithium, graphite and cobalt. Ganfeng and Tianqi Lithium are two major Chinese companies which account for the largest share of the lithium market at 26%. 64% of the world’s graphite is produced by China followed by the country’s control of 80% of the world’s cobalt refining industry. When it comes to battery manufacturing in China, Contemporary Amperex Technology (CATL) and Build Your Dreams (BYD) control 32% of the market.

Battery Supply Chain in Other Countries

In the last decade, Japan and Korea were the leaders in battery and components manufacturing but they did not enjoy the same influence and control over raw materials refining and mining as China which allowed Beijing to leap beyond them. Whatever Japan and Korea lacked in refining and mining, however, they made up for in higher environmental and RII (regulations, innovation and infrastructure) scores as compared to China.

In Europe, a boom is being observed in cell plants because of the growing industry in the region and Europe’s strong environmental credentials. The Nordic countries of Europe which have the strongest environmental credentials are attracting investments in this regard where NorthVolt has established a complete end-to-end battery research facility. It should be noted that Europe didn’t have giga factories initially and was greatly reliant on Asia (particularly, China) to meet its demand.

Giga factories

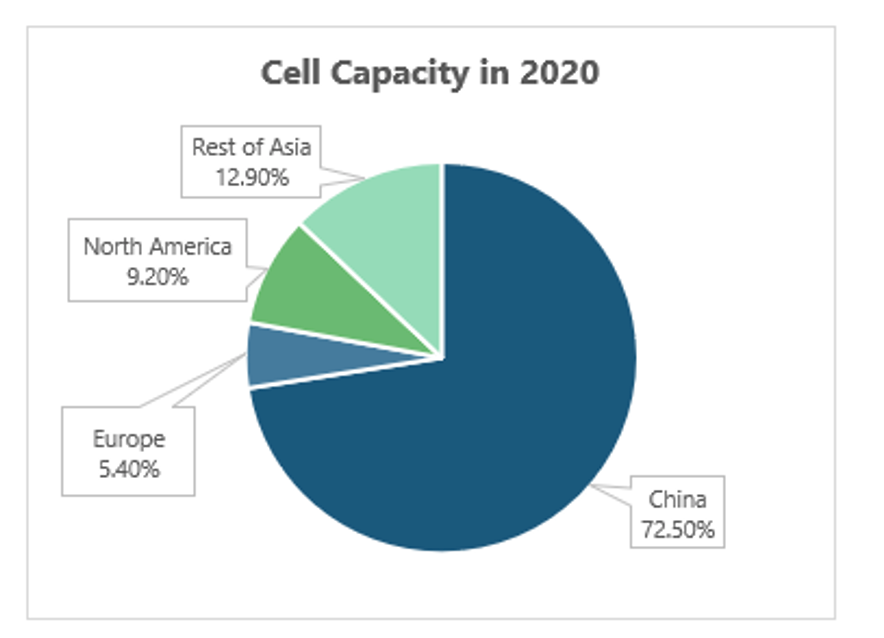

Figure 2: Lithium-ion battery cell capacity in 2020.

Source: Benchmark Mineral Intelligence

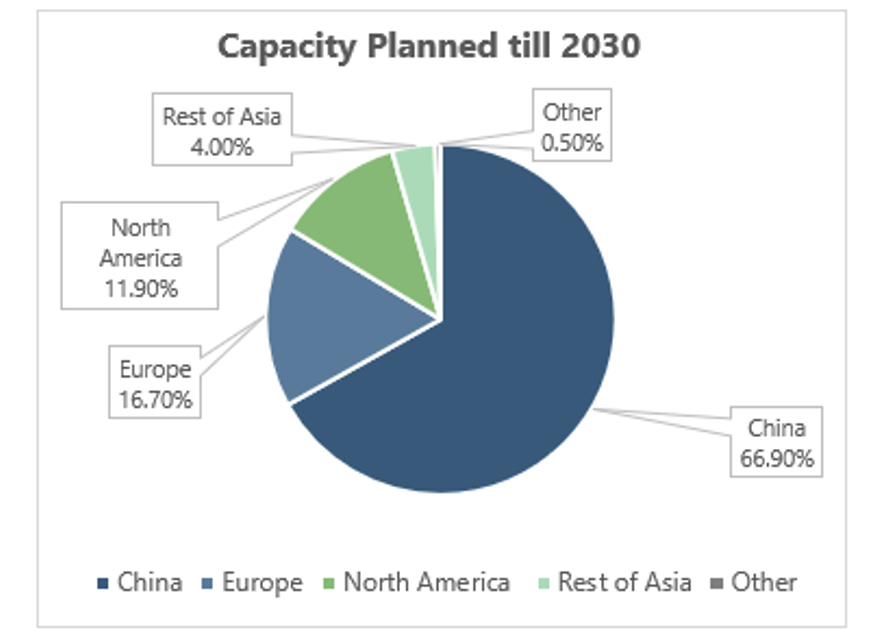

Figure 3: Lithium-ion battery cell capacity in 2030.

Source: Benchmark Mineral Intelligence

According to Benchmark Mineral Intelligence, China is constructing one giga factory per week while the U.S. is building one every four months. The lithium-ion cell capacity globally is expected to increase 6 times from 500 GWh in 2020 to 3000 GWh in 2030. Be it active or under construction, China accounts for 66.9% of the global battery capacity of lithium-ion battery plants followed by Europe and the U.S. forecasted to account for only 16.7% and 11.9%, respectively. Pushed by the government and its industry, Europe is also looking to establish a domestic supply chain of batteries with 38 EV battery giga factories already planned. Secondly, strong local demand for EVs followed by the already existing industrial base and high environmental standards are providing an additional push.

In England, joint venture partners Coventry City Council and Coventry Airport have submitted an application with a plan for a sizable giga factory. The giga factory will have an area of 5.7 million square feet which will be powered by green energy and is expected to create 6000 direct jobs as well as thousands of indirect jobs across the supply chain. In the U.S., other than the 5 battery plants in production, the country has 12 giga factories in the pipeline according to Benchmark Mineral Intelligence.

Looking Ahead

According to Power technology Research, over the next several years, China will remain the leader in the battery storage market mainly due to its consistent investment in the sector followed by tremendous demand originating locally and overseas for its lithium-ion batteries. However, it is significant to note that the lag between China and other countries is expected to reduce moving forward as other regions are increasingly investing in their battery supply chains and moving forward in this direction as well.

Followed by China, the U.S. is the second largest player in the global EV and energy storage market which in turn requires a robust supply chain. Although initially there were only individual companies like Tesla that dealt with energy storage, recent investments by cell manufacturers across the globe followed by Biden’s policy to establish a domestic supply chain is expected to not only provide a push to EVs but also enable local players and welcome new entrants into the U.S. market.

Energy Storage Service Overview

The research presented in this article is from PTR's Energy Storage service. For information about this service please submit a request shown below.

Contact Sales:

More about our:

Energy Storage Market Research

Recent Insights

US and EU Strategies in Smart Buildings

Download Service Overview The EU and USA aim to decarbonize their building sectors to meet emission reduction targets. Initiatives like the Home...

COP through the Ages

This infographic takes a cursory glance at the most significant achievements of the Conference of Parties through the years and offers a chance for...

Battery Pricing Comparison

This infographic provides an overview of the difference in costs of various battery technologies. It also dives into comparing the costs of various...