• Fuel cell electric vehicles are much more efficient than internal combustion engine vehicles and are powered by hydrogen or methanol in some cases.

• Japan has the world’s largest hydrogen refueling network, accounting for more than 154 refueling stations as of last year.

• If countries were to jump on the FCEV bandwagon, as so many in the APAC region already are, the global sales of FCEV (buses and trucks) are set to observe a year-on-year growth of 35%, compared to a 21% CAGR for BEVs.

The electric vehicle industry is segmented into three categories: battery electric vehicles, plug in hybrid electric vehicles, and fuel cell electric vehicles (FCEVs). In North America and Europe, evolved markets in terms of electric vehicles, the focus is heavily tilted towards zero-emission battery electric vehicles, mainly because excessive research and development has already been done in this domain. On the other hand, APAC countries, specifically Japan, China, and South Korea, are focusing on fuel cell electric vehicles as they have already made heavy investments in the hydrogen sector and intend to extend their research on fuel cell technology as well.

Fuel cell electric vehicles are much more efficient than internal combustion engine vehicles and are powered by hydrogen or methanol in some cases. These electric vehicles do not release tailpipe emissions and emit only water vapors and warm air which sits well with the goals set under the Paris Agreement.

Regional Policies Driving FCEVs

Japan, China, and South Korea are key economies in the APAC region that are pushing for the deployment of FCEVs in order to curtail carbon emissions and goals set under Paris Agreement in 2015.

Japan

Japan has the world’s largest hydrogen refueling network, accounting for more than 154 refueling stations as of last year. In order to support the widespread deployment of FCEVs in Japan, the government has plans to introduce regulatory reforms that will facilitate the construction of hydrogen fueling stations up to 320 refueling stations till 2025.

The strategy put forward by Japan’s Ministerial Council on Renewable Energy, Hydrogen and Related Issues in 2018 focuses on promoting the adoption by FCEVs by reducing the price of hydrogen fuel to as low as one fifth of its current cost by 2050. It is expected that Japan will be closer to its target of 800,000 FCVs by 2030, by increasing the price competitiveness of hydrogen fuel against gasoline and liquified natural gas.

The government of Japan is relying on hydrogen vehicles to achieve carbon neutrality in 2050 and has set an ambitious goal of having 200,000 FCEVs on the road by 2025, compared to 3,600 FCEVs in 2019 and 320 hydrogen refueling stations as stipulated under the Third Strategic Roadmap for Hydrogen and Fuel Cells.

Japan-based Honda and Toyota are pioneers in commercial passenger hydrogen models, but South Korean Hyundai has recently also joined the race instigated by government plans to have 6.2m FCVs and built at least 1200 hydrogen refueling stations by 2040.

China

China is focusing on the development of heavy-duty trucks that are powered by hydrogen fuel. The Chinese government released a 15-year plan in November 2020 focused on establishing a fuel cell supply chain and the development of hydrogen powered trucks and buses in the country. It is aiming to have around 1m FCEVs in operation by 2030.

South Korea

South Korea is pushing for a hydrogen economy in order to, primarily, encourage economic growth and enhance the country’s industrial competitiveness rather than to address climate change concerns. The country views hydrogen as a potential driver of the South Korean economy, accounting for USD 43 billion and 420,000 new jobs. It has set targets for hydrogen usage that it plans to achieve by 2040; for instance, South Korea plans to increase the annual consumption of hydrogen from 130,000 tons currently to 5.26m tons per year. In 2020, South Korea announced a target of having nearly 3m FCEVs by 2040, including 2.9m domestically manufactured, 30,000 fuel cell trucks and 40,000 fuel cell buses.

South Korea’s 2040 vision also requires expansion of hydrogen refueling stations (HRS) in the country. In order to expand the HRS network South Korea established the Hydrogen Energy Network in 2019 with an initial investment of around USD 120 Million. As a result, hydrogen refueling stations increased from about 24 in 2019 to 310 by 2022, followed by a long-term target of 1,200 HRS in 2040.

Looking Ahead

If countries were to jump on the FCEV bandwagon, as so many in the APAC region already are, the global sales of FCEV (buses and trucks) are set to observe a year-on-year growth of 35%, compared to a 21% CAGR for BEVs. Power Technology Research also believes that both the electric vehicle technologies (battery electric vehicle and fuel cell electric vehicle) have their own advantages and drawbacks; therefore, an amalgamated future with both technologies, FCEVs and BEVs, is expected.

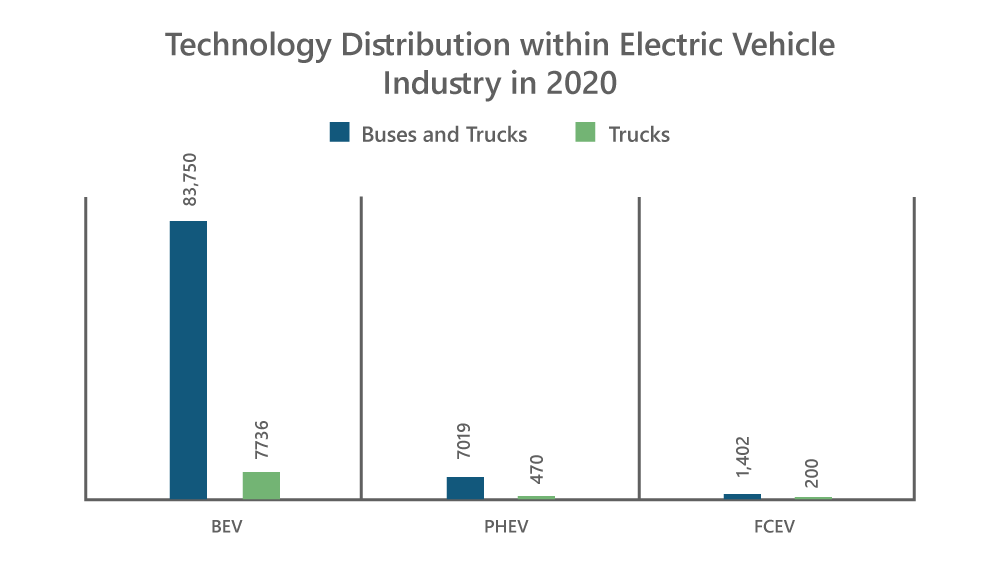

Figure 1: Technology Distribution within Electric Vehicle Industry in 2020

Source: PTR

EV Charging Infrastructure Service Overview

The research presented in this article is from PTR's EV Charging Infrastructure market research. For information about this service please submit a request shown below.

Contact Sales:

Europe

+49-89-12250950

Americas

+1 408-604-0522

Japan

+81-80-7808-1378

GCC/Rest of APAC

+971-58-1602441

More about our:

EV Charging Infrastructure Market Research

Recent Insights

European Electric Vehicle Charging Infrastructure (EVCI) Services Market Landscape

This infographic gives an overview of the electric vehicle charging infrastructure (EVCI) services market in the European region. It highlights the...

Exploring the European EVCI Services Market Key Players and Emerging Trends

There has been a significant surge in the development of EVCI due to the widespread adoption of EVs in Europe. By 2030, it is expected that Europe...

Global EV Market: Analysis of EV Sales Slowdown in 2023

• EV sales were impacted adversely in 2023 on account of various factors, including price disparity, consumer perception and supply chain...